Welcome to JT Finance, the newsletter that broadens your knowledge of the world.

Learn something new? Subscribe to stay up to date with new posts and articles.

Today’s Points

What is Government Debt?

Why Does the Debt Keep Getting Bigger?

Will the U.S. be able to Pay it’s Debts?

The Impact of Rising Debt

As of October 6, 2022 the sum of all government debts has surpassed $31 trillion.

This just sounds like another big number, but to put this into perspective, in 1980 the debt was only at $915 billion. According to my calculations that is a 3,287% increase in 42 years.

Back in 1980, the debt to GDP ratio was 35%. This meant that the U.S. had enough output to pay back its debts.

In today’s world we have a much bigger problem. The debt to GDP ratio sits at 125%. This means our debt is exceeding our output.

With debt to GDP at record highs, what does this mean for our country’s future, and how will it affect us?

What is National Debt?

National debt is the sum of all the debt owed by our government.

The Federal Government borrows money to cover outstanding balances of expenses that it collects over the years.

Whenever our spending exceeds our revenue we have a deficit, and this budget deficit is paid for by issuing out debt.

The U.S. has been running a budget deficit for every year, but 4 (1998-2001), since 1970. This means that we have accrued a lot of debt over the past 50 years, and it is still growing.

In a healthy amount, debt is considered to be a good thing.

Debt enables the U.S. government to pay for important programs, infrastructure, increased growth, investments, etc. Without debt, it would have been impossible to see the amount of growth that we have seen over the past 52 years.

There are two types of debt that the government has; public debt and intragovernmental debt. These two types of debt combine to make up the national debt.

Public Debt

Public debt is how much a country owes to its’ lenders.

When the government needs to borrow money, they issue bonds out to the public. This includes treasury bonds, bills, notes, floating rate notes, and Treasury inflation-protected securities.

A citizen or investor buys one of these instruments, and lends money to the government. The government has to pay them back with interest depending on the maturity date, and interest rate of the instrument.

U.S. treasury securities are considered to be ‘risk-free’ investments, because it is backed by the government.

U.S. citizens and businesses aren’t the only lenders to the government. Other countries are one of the biggest contributors to the public debt. China and Japan are the largest foreign owners of U.S. debt.

Intragovernmental Debt

Intragovernmental debt, is money that they government owes to itself.

Government accounts and trust funds typically lend to the government if they have any surpluses. 22% of the national debt is held by intragovernmental accounts, this total around $6.6 trillion .

Some of the holders are social security, military retirement, civil service retirement, healthcare, and Medicare.

Here is a breakdown of the national debt

Why Does the Debt Keep Getting Bigger?

The simple answer to this question is that the government is just spending too much money. Now, I know you are probably thinking of the simple solution to this problem, “just stop spending money!”

This sounds super easy, but it is more difficult than you think. It is also a highly unpopular decision with politicians.

To understand where all of this money is going, we need to break down their expenses.

Government Spending

According to USASpending.gov the total expenses for the fiscal year 2022 are around $7.8 trillion.

This is scary, because our U.S. federal tax revenue for this year is estimated to be around $4.17 trillion. This means we are going to running a $3.6 trillion deficit that will have to be funded by issuing more debt.

Now let’s break down exactly what we are spending money on.

In 2022, 16.5%, or $1.3 trillion, goes to Medicare. This pays for health insurance for ages 65 and up, and also covers people with disabilities.

15.3%, or $1.2 trillion, is spent on social security. This supports retired citizens, disability insurance, and supplemental security income payments.

National Defense is the next biggest expense, coming in at $1.1 trillion. The government spends $1 trillion on healthcare.

$800 billion is spent on income security, this is things such as unemployment, federal employee retirement, food and nutrition, and Covid-19.

The last major expense is the smallest, but also the scariest. Interest expense is around $700 billion dollars. Five years ago, the interest expense was $470 billion.

Mandatory Expenditures. With national debt rising rapidly by the day, this is only going to cause interest expense to rise with it. What would happen if the interest expense became the biggest cost of the U.S. government?

There would be a lot less money for these other mandatory expenses that the government has to pay. These entitlement programs include social security, Medicare, Medicaid, and unemployment benefits.

The problem with these expenses is that the government is obligated, and has promised to pay them.

Imagine if the government just stopped paying for healthcare, Medicare, social security, national defense, and income security. Things would turn into chaos really quick.

The point I am trying to make is that most of the government’s expenses have to be paid. Mandatory expenses are estimated to be around $4 trillion this year, and these expenses can’t be cut down.

If debt and interest expense continue to rise, this means the deficit will grow even larger, because we can’t cut any other expenses on the budget.

War & Stimulus. According to the article “The Balance” (2022), the presidents who had to pay for the world wars are both at the top of the list of biggest percentage increases in the national debt.

This is Franklin Roosevelt and Woodrow Wilson.

The government had to spend billions of dollars on the war effort, and since the budget deficit was so big, we had to issue bonds and borrow the money.

The next biggest thing presidents spend money on is stimulus, most notably Barack Obama during the Great Financial Crises, and Franklin Roosevelt during the Great Depression.

Presidents provide stimulus when the economy is in shambles to help boost economic activity and growth, but this takes a huge toll on the national debt.

Debt Ceiling

The funny thing is we actually have a limit to how much money we can borrow, and this is called the debt ceiling.

The debt ceiling is set by congress, and limits the federal government from surpassing it. When the government reaches the limit, the treasury cannot issue any more securities to finance the government.

This causes budget issues where the treasury has to make a choice between paying for government programs, or defaulting on the interest expense. This leaves politicians in a sticky situation.

Politicians usually take the easy way out, and just choose to raise the debt limit.

In fact, since 1960 congress has kicked the can down the road 78 times to temporarily extend, or permanently raise the debt limit.

Congress doesn’t hold the treasury accountable for its’ spending problems, and they just extend the leash a bit further each time.

In my opinion, politicians will always choose to raise the debt limit, because people are naturally self-interested. There would be way less conflict if you just raise the debt limit instead of telling the whole nation that they won’t be receiving their social security payments.

We aren’t fixing the problem; we are just delaying the disaster.

The current debt ceiling is set at $31.4 trillion, and we are approaching that limit fast. Politicians will soon have to make another decision. Do we increase debt or decrease spending? We all know what decision they will make.

Will the U.S. be able to Pay its Debts?

When a country’s debt-to-GDP ratio gets above 100% investors get concerned with that country’s ability to pay off their debt.

In order for an investor to feel comfortable buying this country’s debt, they will demand a higher interest rate on the bond.

The more risk, the higher the bond yield.

U.S. debt-to-GDP is at 125%, so this means our debt is bigger than our output. Investors aren’t as confident in the United States’ ability to pay off its debt, so this is precisely why we are seeing the interest rates on U.S. treasuries rise.

Higher interest rates make borrowing money more expensive for the U.S. government, which could cause problems to arise if the government can’t get funding.

How are they Paying off the Debt?

“The United States has not run an annual surplus since 2001, and has thus borrowed to fund government operations every year since then. (Rouse, 2021)”

This quote from Whitehouse.gov is telling us that the government doesn’t make enough money to finance its expenses, so how are they paying their lenders back?

The scary answer to this question is they are issuing more debt to pay off the current interest expense.

In an article by Hannah Lang, she quotes David Andolfatto, Senior Vice President in the Research Division at the Federal Reserve Back of St. Louis, and he says:

“It’s true that when a particular security matures, Treasury has to find the money to honor the treasury security as it matures, but what it can simply do is go to auction and re-auction off a new security to raise the necessary money. So, in this way, the government actually never has to pay back the debt. (2021)”

This is basically like someone opening up a new credit card to pay off their old credit card.

So, does this mean the United States can just expand the debt forever?

Interest Rates

In the current world we live in the Federal Reserve is trying to fight inflation, and the way they are doing this is by raising interest rates.

We have seen throughout history that this is a good tool to combat inflation, but inflation is still high.

The Fed has already increased rates from .25 to 4.50% since March of this year. This is the fastest rate hike in history.

If the Fed continues to raise interest rates, this could cause a serious problem for the government.

Hannah Lang quoted David Andolfatto again in her article, and he said, “Even if the debt doesn’t shoot up super high, when you have so much, even a small increase in interest rates leads to a big increase in interest payments. (2021)”

This chart below shows average interest rates on treasuries, and we can see it is starting to rise.

If the Fed doesn’t get inflation under control soon this will increase interest payments substantially, and further increase our spending deficit.

The treasury has greatly benefited from low interest rates over the past decade, and this has kept interest payments pretty low.

We will soon see how things play out in this raising interest rate environment, and what kind of decisions the government will make.

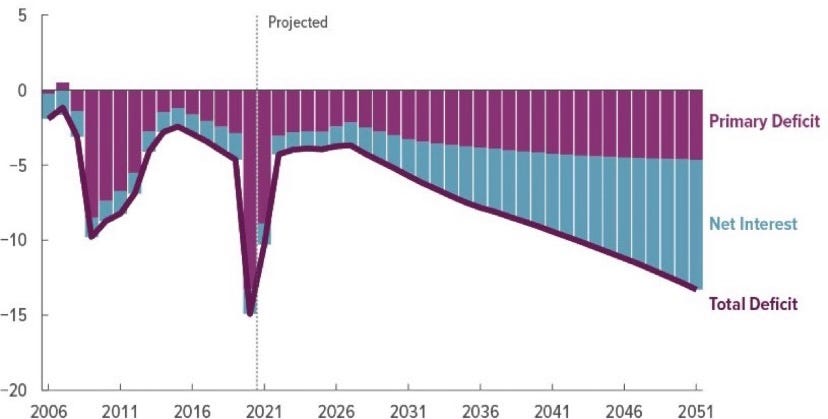

Projected Interest Payments

In 2020, the Congressional Budgets Office’s projections show that the cumulative deficit from 2021 through 2030 to total nearly $13 trillion.

The government will finance this deficit spending by borrowing more money, and with interest rates on the rise the CBO believes this will double the net interest outlays over the next 10 years.

It is likely that the government will just continue to raise the debt ceiling so they can pay off this rising interest expense.

They cannot do this forever, and now we will talk about the implications of these decisions.

The Impact of Rising Debt

Like I said in previous parts, debt is a good thing for the economy. Debt helps increase productivity, growth, and stability.

When the government spends money, this creates jobs, and this sparks all sorts of economic activity. Federal government spending accounts for about 7% of GDP, so this is a huge part of the economy.

Most economists would agree that debt is a great tool, but the problem arises when there is too much of it.

Slowed Economy

A study by the World Bank in 2013 found that if the debt-to-GDP ratio exceeds 77% for an extended period, it slows economic growth.

They also said that every percentage point of debt above this level costs the country .017 percentage points in economic growth.

When the debt to GDP is high investors worry about the ability of the country to pay back the debt. Weakened demand for treasuries increases interest rates, and increased interest rates also slows down the economy.

In Hannah Lang’s article it reads, “If the government accumulates enough debt, eventually money that could have been used for investment in economic growth will have to be used to make interest payments instead. (2021)”

If interest rates keep rising like they are expected to, this will increase the debt servicing cost. This would lead to less spending on things that boost the economy, and more on the interest expense.

Debt Spiral

A debt spiral is when a country’s debt levels increase until the debt and interest payment levels become unsustainable.

This leads a country to default on their debt.

An article from the White House says, “The scope of the negative repercussions of not satisfying all Federal obligations due to the debt limit are unknown; it is expected to be widespread and catastrophic for the U.S. (and global) economy. (Rouse 2021)”

A U.S. government default would cause hardship in every country, because everything is built on top of the dollar and debt.

I believe that we are actually trapped in this debt spiral right now.

Here is how I see it playing out. Federal spending is only going to increase, because of the bad economics conditions that we are headed into. The obligated expenses will have to be paid, because they were enacted by congress and put into law.

This leaves a very little amount of the budget for interest expense. With interest rates rising, the interest expense will only get bigger from here, and this will put us into an even bigger deficit.

This deficit will have to be funded by more and more debt. Eventually, there will be a breaking point when there is no demand for U.S. treasuries, and there will be no way for the U.S. to pay back its debts.

There is no way out of the debt spiral, and it will eventually lead to a collapse of the system.

Printing Money

Sadly, the scenario above isn’t even the scariest effect of increasing debt. The United States actually does have one option to prolong the debt spiral, and it is printing money.

“The U.S. can’t run out of money to pay investors, because the U.S. controls its own currency. So, unlike countries that don’t have a central bank, the U.S. government is self-financing. (Lang 2021)”

This is the scary truth about the power of the central bank.

Earlier, we said that the debt system will collapse when there is no demand for treasuries, and the U.S. would default. This is true, but the federal reserve and the government could work together to prolong this spiral.

In the article by Lang, she quotes Andolfatto of the ST. Louis Federal Reserve again, and he says:

“The question of what happens if the bond vigilantes come back and they don’t want to buy the government debt, sending interest rates higher? Well, the answer to that is the Fed can step in and buy it. The Fed is always in a position to step in and buy it and keep interest rates low. (2021)”

This is called Yield Curve Control, when a central bank is creating money to buy government bonds in order to keep interest rates low.

This is currently happening in Japan.

There is no demand for their bonds, but their central bank is coming in and buying the bonds to keep the yield down, and help to fund the government deficit.

The effects of this technique are not good. The Japanese Yen has fallen 33% compared to the dollar since 2020.

Creating new currency to buy government bonds will lead to inflation, and a currency collapse.

Japan’s debt-to-GDP ratio is 263%, so they have a much bigger problem than the United States, but this is the path that we are headed for.

There will be a point in the future where the U.S. will have to decide to default on their debts, or print money to pay off the debts, but debase the currency in the process.

Conclusion

It is extremely important to understand the financial situation of our government so we can plan accordingly.

Not financial advice, but in my opinion the money printers will have to come back on, and this means a debasement of the currency. It’s a mathematical certainty, and when it does all assets will rise compared to the dollar.

I believe hard assets like gold, silver, real estate and bitcoin will benefit from this the most. People will lose faith in government fiat money, and flee to assets that are hard to produce.

The government’s finances do have an impact on your wealth, and it is imperative to have some protection against this threat.

That’s it for this post. I hope you feel a little bit smarter after knowing the government’s debt situation. This is by far the biggest threat to the U.S.

Before leaving, feel free to respond to this newsletter with any questions or recommendations for future topics.

References

Understanding the National Debt

The national debt is big and getting bigger. Does it matter? By. Hannah Lang